Cynthia Murray was admittedly in a bad mood around a month ago when the U.S. House of Representatives voted on a controversial tax “reform” bill that may deliver a uniquely regional measure of pain to Marin County.

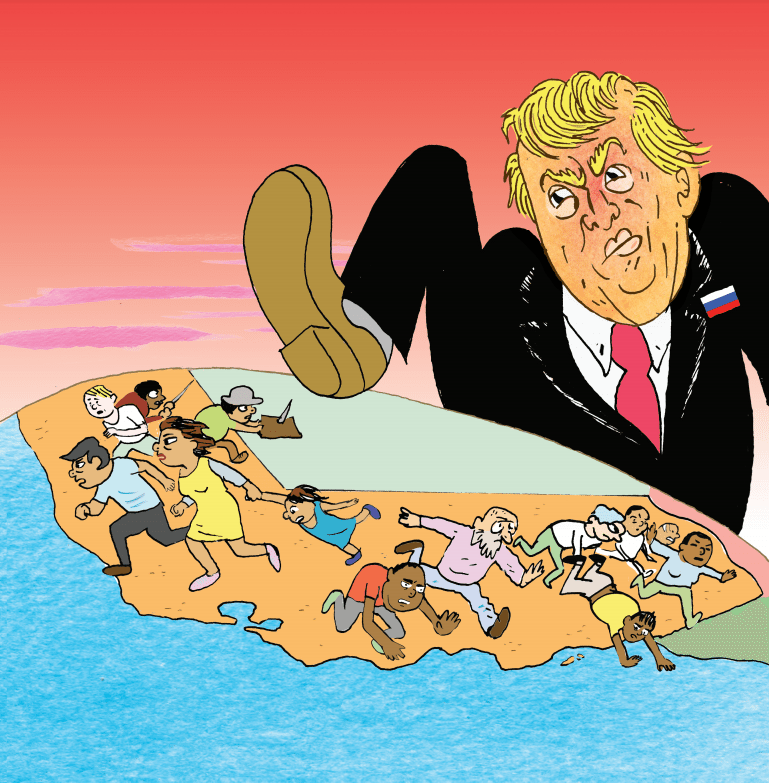

Murray, who formerly served on the Marin County Board of Supervisors, is a Petaluma resident and President and Chief Executive Officer of the North Bay Leadership Council. She addressed an audience in San Rafael during a Marin Communications Forum event in early December and laced into the Republican Party for its tax package, which is now in the reconciliation phase of negotiations as the Senate and House work to send a bill to President Donald J. Trump’s desk by Christmas.

There’s lots of tweaking going on and it’s unclear what will make the final cut of the tax bill, but the basic drift is that it’s a giant giveaway to American corporations which will see their tax rate plunge from 38 percent to as low as 20 percent. In the meantime, there are struggling families everywhere. An oft-repeated Republican talking point on the tax bill is that tax cuts are generally wasted on poor people because they spend all their money, as Utah Senator Chuck Grassley put it, “on booze, women or movies.”

Murray took umbrage with the characterization in her opening remarks.

“How many people intend to do that?” Murray asked the crowd gathered in an Embassy Suites conference room. “Raise your hands. Talk about out of touch,” she said, as she semi-apologized to the crowd for her entertainingly sour mood. Nobody seemed to mind.

Murray rattled off some recent real estate listings in Marin—a $900,000 property, another listed for $42 million and another that listed at a reasonable $285,000. “That must be someone’s garden shed,” Murray quipped.

There’s good reason for Murray’s miffed mindset and for any prospective homeowners in Marin County to be worried about the GOP tax bill that’s currently being rushed through Congress.

Some of the measures targeted at homeowners or potential buyers have been singled out by state and national realtors’ organizations that typically support Republicans, as being not a very wise homeownership-encouraging policy from their perspective.

The tax package sets out to double the standard exemption for most filers, while also eliminating tax breaks and deductions that encourage home ownership. And the GOP plan would allow homeowners to write off the interest on their mortgage payment from the federal government for the first $500,000 in borrowed money. Another proposal would negatively impact homeowners, who would no longer be able to write off the first $10,000 in property taxes paid to localities.

Under current tax law, the mortgage-loan interest can be written off on loans up to $1,000,000. (GOP Senate leaders said Tuesday afternoon that they were thinking about splitting the difference and setting the new write-off limit at $750,000.)

This proposed change in tax law has, and continues to be, supported by progressive organizations such as the National Low Income Housing Coalition (NLIHC), which for years has pushed for the $500,000 threshold (on the grounds that the $1 million threshold is unfairly generous to the wealthy) and use the additional revenue to create a low-income housing trust fund.

The so-called “California problem” is one of relativity: $500,000 doesn’t have the buying power in Marin as it has in Maine. It doesn’t have the buying power in GOP strongholds like Orange County, either.

And the problem for the Bay Area in general, now writ large across a state that’s perpetually in flames, is a severe housing shortage that has just gotten worse because of the North Bay wildfires, which destroyed 6 percent of the regional housing stock. And according to the real estate researchers at HomeLight, the fires almost immediately triggered a $100,000 spike in average regional home prices (HomeLight’s business model matches realtors to home-buyers; the company has offices in San Francisco and Arizona).

According to the NLIHC data, while 95 percent of all home-mortgage loans written annually in the United States are for less than $500,000—20 percent of all loans written in coastal blue state California are for more than $500,000. And, the 20 percent figure is driven mostly by the Bay Area and Marin County—one of the most expensive counties in the United States—and Republican strongholds to the south (i.e., Orange County). In Marin, where the pre-fire median price of home-ownership is a cool $1.2 million, nearly half of all mortgage loans are for more than $500,000, according to the NLIHC data.

All of the well-traveled Marin County quality-of-life headaches are driven by the housing shortage here, said Murray, to say nothing of the general unaffordability and inaccessibility of ownership to average people. Highway 101 is forever congested with workers who labor in Marin but can’t afford to live here (60 percent of all workers in Marin commute from other places), she noted and the solution is pretty simple, at least on paper: “More housing is the solution.” But tell that to George Lucas.

Murray highlighted that the Marin County open space mandate to maintain and protect massive tracts of land from developers (approximately 85 percent of the county is undeveloped), has not been met with the other part of the implied quality-of-life deal: High-density development along the Highway 101 corridor has not happened. Demand has outpaced supply, and the supply just took a huge hit.

The North Bay fires just destroyed 6,000 houses in the region. And it was just a few years ago that Marin County told Lucas to stick to making movies and lay off the affordable housing ambitions. An inexplicably short-sighted moment of infamy for a county with a severe housing crisis, as Murray noted. “And it just got worse with this damn tax bill they just passed.”

Robert Eyler, an economics professor and a member of the Marin Economic Forum, also keyed-in on the Republican tax bill and its potential for deleterious impacts on Marin, during the early December forum in San Rafael.

Eyler noted that the region has done pretty well in the post-2008 economic recovery and that the big question being asked these days by economists is not so much about creating jobs—but in creating jobs that “let people live where they work,” which is not happening at the moment in much of Marin County.

According to Eyler, even as 60 percent of the workforce leaves every day, 60 percent of the workforce commutes into the county every day, and the former earns three times what the latter does: The outbound commuters are highly paid (the median Marin income is $90,000); the inbound commuters typically are not. Eyler highlighted that home-ownership ought to be prioritized in the county, which starts with actually building some housing, given the stabilizing and wealth-building benefits that buying a house can provide. But the GOP bill as it stands creates a raft of disincentives to first-time homeownership, even if as Eyler emphasized, “It is way better to own than to rent.”