By Caitlin Yoshiko Kandil

For years, David Hua encountered problems when he ordered medical marijuana deliveries. Online menus were often outdated. Ordering over the phone took forever. Sending requests by email risked compromising private data. And delivery dudes were notoriously unreliable.

“Sometimes it took an hour, sometimes longer, sometimes shorter, but you never really know,” he says. “The larger windows made it difficult to schedule your day. But since you’re ordering medicine, you’d wait just like you’d wait for the Comcast guy.”

Hua, who has used cannabis for the past five years to relieve chronic neck and shoulder pain, knew there must be a way to improve service, especially in the Bay Area, where one can order everything from takeout to manicures on demand.

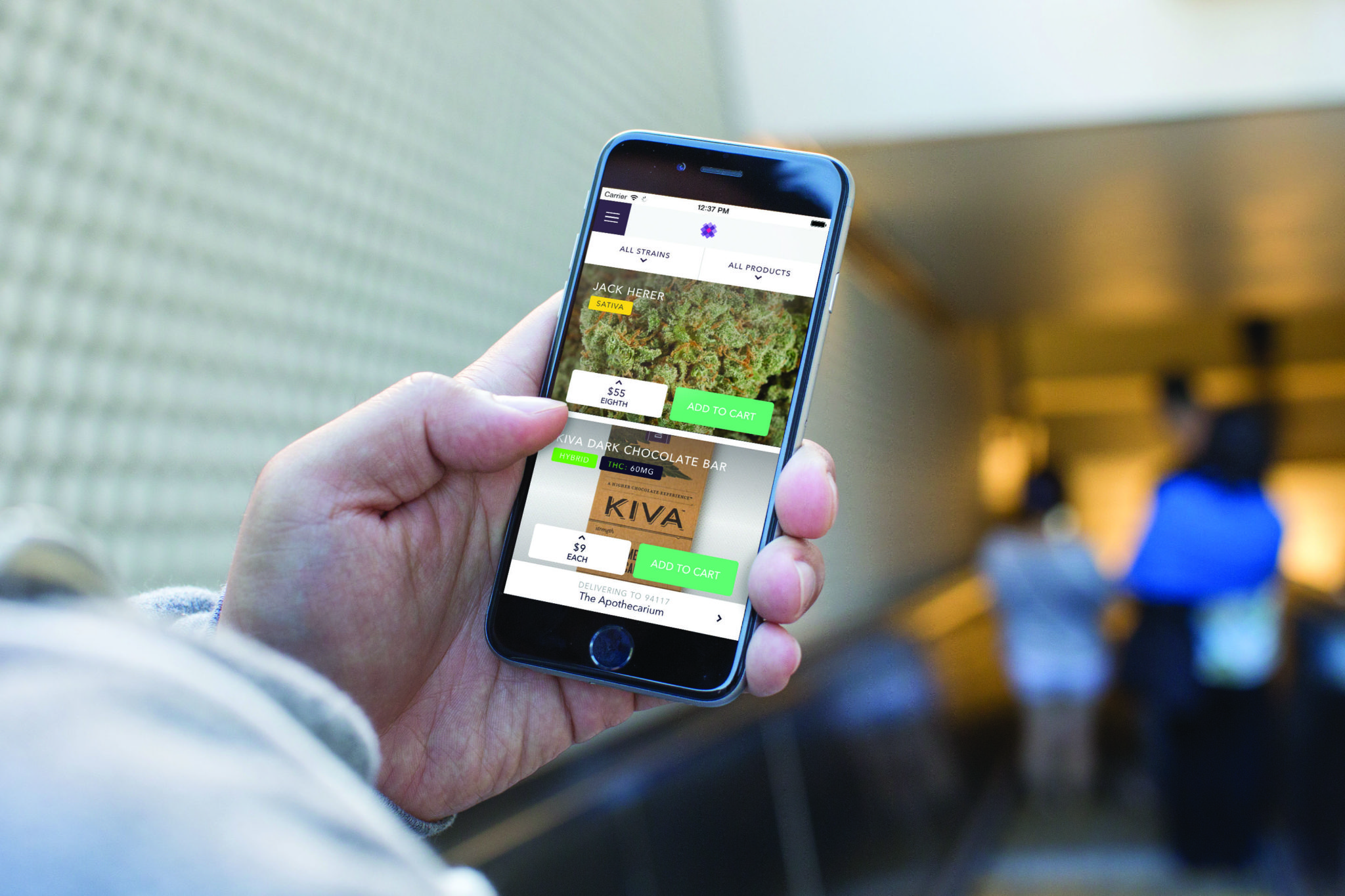

So in 2014 Hua launched Meadow, a one-hour delivery service for more than 30 Bay Area pot clubs. Customers order by smartphones and get estimated delivery times with real-time tracking updates. Online menus update inventory. Patient information is stored on HIPAA-compliant servers. Meadow also offers video chats with doctors who can prescribe cannabis, and software to help collectives more effectively.

Known as the “Uber for medical marijuana,” Meadow became the first pot-related startup to land funding from the Mountain View-based seed accelerator Y Combinator. Meadow has joined a burgeoning medical marijuana industry, which has been dubbed the “green rush” but might as well be the modern-day gold rush, given its growth and profitability.

“Just as the gold rush once needed tools such as pick axes, shovels and jeans, now the tools are online ordering, compliance, streamlining their operations and making sure best practices are followed,” Hua says.

Legal cannabis sales topped $5 billion in 2015, according to industry research firm ArcView Group, and the cannabis sector is expected to reach $6.7 billion this year. By 2020, the legal cannabis market could reach nearly $22 billion in sales.

“In Silicon Valley, entrepreneurs and investors are always looking for the next thing that technology can disrupt, the next marketplace where there’s an incredible growth curve that they can participate in,” ArcView CEO Troy Dayton says.

“In that way, the cannabis industry is seen by many as the next great American industry.”

But unlike other industries, Dayton notes, cannabis will be driven less by technological innovation or customer taste than by changes in public policy. In 1996, California became the first state in the country to legalize medical marijuana.

Since then, 24 states as well as Washington, D.C. have decriminalized the drug to varying extents. California has yet to legalize general adult use—a ballot initiative is in the works after a 2010 effort fell 7 percent short. Meanwhile, 21-and-over adult use is now legal in Washington, Colorado, Alaska, Oregon and the District of Columbia.

The nation’s shift towards legalization—58 percent of Americans now support it, according to Gallup—has opened the doors to a growing cannabis industry in California. Governor Jerry Brown signed off on a slew of new regulations surrounding medical marijuana last fall, giving businesses and buyers more clarity on how to operate above board.

“Because of this shift,” Dayton says, “the best minds of our generation are just finally starting to put their attention on this space.”

Hua agrees: “If we had tried to do this five years ago, I don’t think the market would have been there because people’s risk appetite and exposure weren’t there.”

Cannabis-related startups now include a variety of consumer devices, delivery services, social media, software products and agricultural innovations. Loto Labs, based in Redwood City, developed Evoke, an induction-powered vaporizer that allows users to customize heat and dosage settings on a built-in control panel or smartphone app.

“You’re able to see how much you’re puffing, just like your Fitbit tells you how many steps you’ve climbed,” says Neeraj Bhardwaj, president of Loto Labs. “If you have cancer and you’re trying to dose correctly, or if you’re trying to quit smoking, you can track your progress.”

San Francisco-based HelloMD offers telehealth services that connect patients to cannabis-friendly doctors.

“Going to a regular healthcare provider for cannabis is problematic for most people,” says company founder Mark Hadfield. “Your traditional doctor is going to say, ‘I don’t feel comfortable, I haven’t seen enough studies, or I don’t know how to provide a recommendation.’”

HelloMD also allows patients to order medical marijuana and have it delivered.

“This experience means that patients who have never participated in cannabis are more willing to,” Hadfield says. “We’re seeing the demographic shifting, from young people who are recreationally oriented to an older demographic with more women, who are using cannabis for health and wellness. These people are coming into the market for the first time because of the ease and convenience of the service and lack of stigma. The technology means that they can now participate.”

Even PayPal co-founder Peter Thiel has put his stamp on cannabis startups. Last year his investment firm, Founders Fund, joined a $75 million investment for Privateer Holdings, a private equity firm that invests in the medical marijuana industry.

But not everyone is seeing green. David Welch, founding partner of DR Welch Attorneys at Law, which specializes in the business aspects of the medical marijuana industry, expresses skepticism toward the so-called modern-day gold rush.

“There’s a lot of fool’s gold out there,” he says. “You’ll become a millionaire a lot faster on Wall Street than buying and selling marijuana.”

Silicon Valley has started to flex its power beyond investments, though; it’s also throwing weight behind policy reforms. In January, Sean Parker, of Napster and Facebook fame, announced that he was donating $250,000 to support a legalization initiative. The Adult Use of Marijuana Act is slated to appear on California ballots this fall.

While the proposal has received support from groups such as the Drug Policy Alliance, the Marijuana Policy Project of California and the NAACP, groups such as the California Growers Association and ReformCA.org feel extensive regulations will hurt small growers.

“It’s disappointing to see Sean Parker attempting to restrict it to where, logistically, only people who have a great deal of money and influence can participate in the industry going forward,” says Mickey Martin, director of ReformCA.org. “It creates a lot of red tape and additional cost that keep the price of cannabis high and makes it difficult for the normal mom and pop business to operate under that regime.”

Welch agrees, adding that the transformation of the marijuana industry has created tensions between new businesses and longtime players.

“You see a lot of fear on behalf of the old guard, that they’re going to lose their livelihood to people who have less experience but a lot more money,” he says.

But ArcView’s Dayton argues this isn’t the case. “The best teams,” he says, “are always a mixture of longtime cannabis talent with longtime business talent.”